Immigration eases rules on Aliens’ Visa

The Bureau of Immigration said Friday it will temporarily allow foreign nationals with approved visas but who are still awaiting the release of their Alien Certificates of Registration Identity Cards to leave the country.

The Bureau of Immigration said Friday it will temporarily allow foreign nationals with approved visas but who are still awaiting the release of their Alien Certificates of Registration Identity Cards to leave the country.

The agency says the move is in light of the Enhanced Community Quarantine and Stringent Social Distancing Measures directive from Malacañang. Immigration Commissioner Jaime Morente says the regular procedures require departing aliens with approved visas but pending ACR I-Cards to secure a waiver at the agency’s main office. ‘Hospital ships’ Senator Francis Tolentino is urging the Transport department to use vacant passenger ships as “hospitals ships” because of the rising COVID-19 infections, which he says has resulted in overcrowding in the hospitals. He says the agency could initially convert three ships as temporary medical facilities.

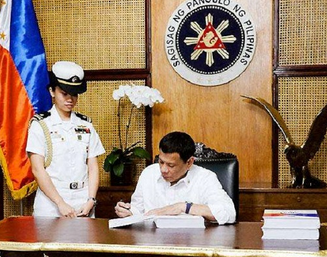

The national budget for 2020 has been signed into law by President Rodrigo Duterte on Monday. The General Appropriations Act of 2020 is ₱4.1 trillion, 9 percent higher than the previous year’s 3.76 trillion budget. The budget wasn’t signed at the end of 2019 because the President requested “thorough” scrutiny of the bill. President Duterte said in his speech that this year’s spending plan would support the government’s goal of making the Philippines an upper bracket-income country, and lowering poverty to 14 percent by the end of his term. He remarked that just like in previous years,

The national budget for 2020 has been signed into law by President Rodrigo Duterte on Monday. The General Appropriations Act of 2020 is ₱4.1 trillion, 9 percent higher than the previous year’s 3.76 trillion budget. The budget wasn’t signed at the end of 2019 because the President requested “thorough” scrutiny of the bill. President Duterte said in his speech that this year’s spending plan would support the government’s goal of making the Philippines an upper bracket-income country, and lowering poverty to 14 percent by the end of his term. He remarked that just like in previous years,